The COVID era brought multiple deadline extensions for participants of employee benefit plans. Employers are all too aware of these changes and of the many special communications and administrative procedure changes that they require.

The special COVID rules extended certain ERISA deadlines as well as COBRA, HIPAA Special Enrollment, and benefits claims and appeals timelines. These changes were effective March 1, 2020.

With the end of the COVID national emergency, those deadline extensions ended. Specifically, they terminated at the end of the Outbreak Period, which is the earlier of 60 days after the end of the National Emergency (May 11 + 60 days = July 10, 2023) or one year from the date an individual first became eligible for the extension.

Encouragement to Extend Special OE Period

A joint letter from the Center for Medicare and Medicaid Services (CMS), Treasury, and DOL dated July 20, 2023, was issued to employers, plan sponsors, and issuers. In it, the Biden Administration encouraged entities to extend the 60-day special enrollment period required by HIPAA for individuals losing Medicaid and CHIP and to offer additional enrollment opportunities in group health plans for employees and their dependents who are losing coverage under Medicaid and CHIP. Ideally, this extension would match the temporary special enrollment period on HealthCare.gov that runs from March 31, 2023 – July 31, 2024.

Why This? Why Now?

During the COVID-19 Public Health Emergency, Medicaid programs paused coverage verifications and eligibility terminations to provide continuous coverage subsidized by enhanced federal funding. The continuous enrollment provision ended on March 31, 2023, and Medicaid is now resuming regular eligibility operations, including terminating coverage for those who are no longer eligible.

As a result of this, it is projected that millions of individuals will lose Medicaid and CHIP coverage. Importantly, the HHS projects that 3.8 million of these individuals will be eligible for employer-sponsored coverage. To encourage maintaining health coverage, the Biden Administration wants employers to assist these employees, specifically by easing the process of enrolling in group health plan coverage.

Medicaid is administered by each state, and there is no uniform enrollment process or required notice to individuals when they lose Medicaid coverage. In fact, individuals may not even know they have lost coverage until they seek health care. Given this unfortunate reality, they will not know to seek other coverage within the standard 60-day window to apply for new coverage (either through an Exchange or under a group health plan) after losing Medicaid or CHIP coverage.

Extended Special Enrollment Period for Enrolling in Exchange

Recognizing this predicament, the CMS created a temporary special enrollment period for the federal Exchange. Individuals who lose Medicaid or CHIP coverage and apply for coverage under HealthCare.gov between March 31, 2023, and July 31, 2024, will be able to enroll under the extended Special Enrollment period.

Recommendation for Employers to Follow Suit

The joint letter to employers encourages them to follow suit by temporarily expanding the special enrollment periods for individuals to enroll in group health plan coverage after losing Medicaid or CHIP coverage. As with Exchange coverage, enrollment would be on a prospective basis only; there would be no retroactive coverage opportunity.

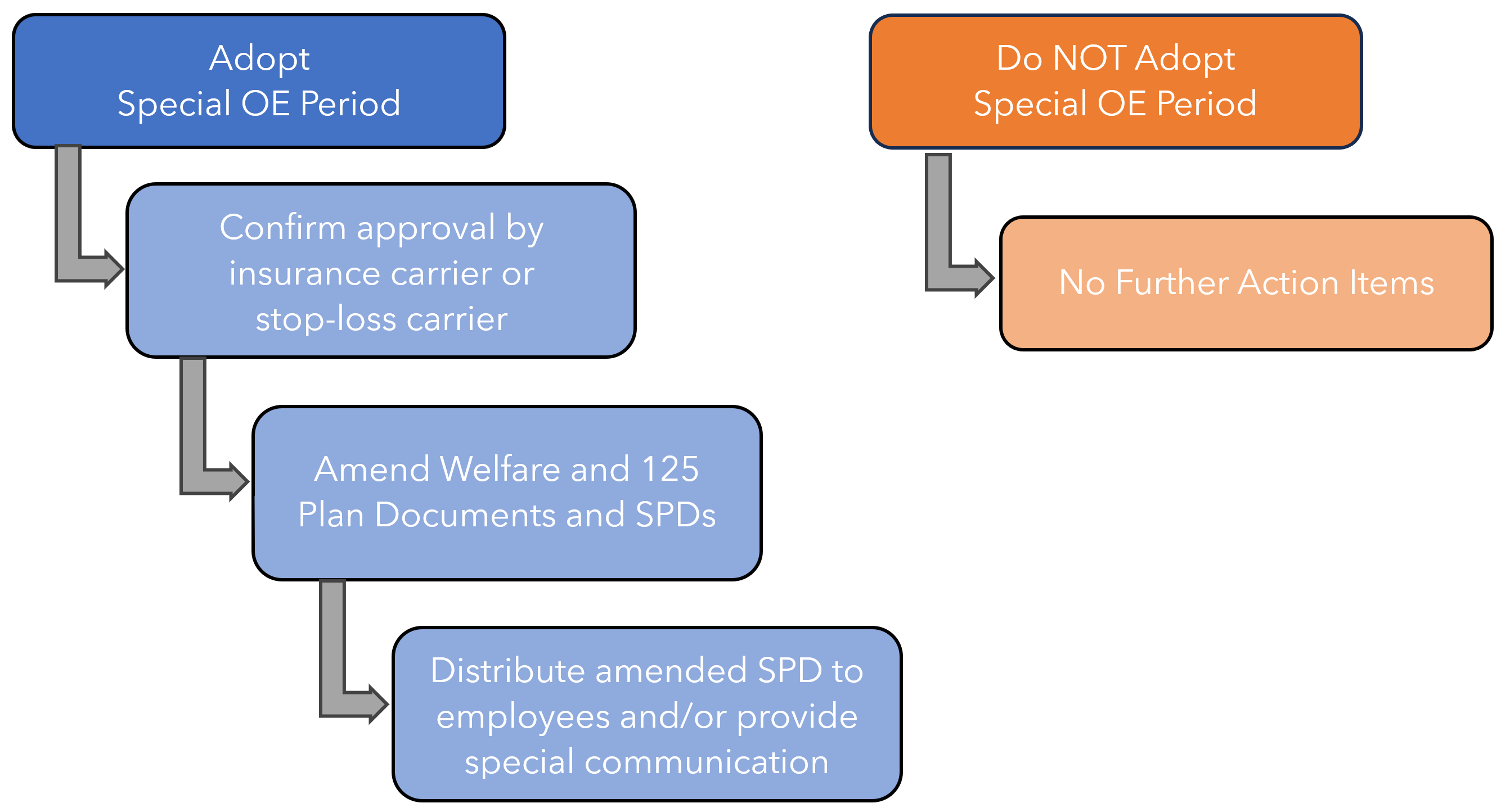

Employer Decision Overview

Employers must decide whether or not to adopt an extended Open Enrollment period to align with the Marketplace Special OE period. The decision is voluntary. If adopted, it will require plan amendment and approval from the insurance carrier as well as communication to plan participants. If not adopted, no such special enrollment opportunities can be allowed under the plan, as plan provisions must be administered uniformly. Following is a decision-tree visual:

Vita Defaults

Vita will take the action of assuming clients will NOT adopt this temporary expansion of Special Enrollment rights. This means that customizations to welfare and pre-tax Plan Documents/SPDs will not need to be made.

However, to the extent that employers want to amend their plans to include this provision, document updates will be made. In this case, since the expansion of rights is temporary, we will make document changes using a Summary of Material Modification (SMM), rather than making updates to the documents themselves (and then having to remove the provision in July 2024). This will allow for a “clean” update to the documentation with minimal processing. It will mean, however, that the SMM document will need to be distributed along with the SPD during the period when the special enrollment rights expansion is in effect.

Employer Action Item

For employers wishing to NOT ADOPT the provision, no action is necessary.

For employers wishing to ADOPT the provision, please email your Vita Account Team to advise them of this election. This will activate the process of Vita creating a Summary of Material Modification document to reflect this change in your plan.

References

CMS Letter to Employers